Debit Cards

Use your card wherever your heart desires and shop online as much as you could. Roam your Money.

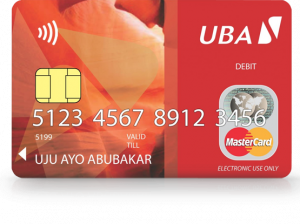

Debit MasterCard

The UBA Debit MasterCard is a debit card issued on your account in Liberia. Therefore, you can use your card anywhere in the world. You can travel anywhere you want, stay wherever your heart desires and shop online as much

as you wish. This is what we mean by, ‘Roam Your Money’.

The UBA Debit MasterCard is a debit card issued on your account in Liberia. Therefore, you can use your card anywhere in the world. You can travel anywhere you want, stay wherever your heart desires and shop online as much as you wish. This is what we mean by, ‘Roam Your Money’.

Your UBA Debit MasterCard is extremely versatile and simple to use. You have the convenience of paying for your purchases directly from your bank account, without having to carry any cash. That’s the cashless lifestyle! Yet, your card and your transactions are highly secured with the best card technology.

If your UBA Debit MasterCard gets lost or stolen, you are protected against fraudulent purchase transactions from the moment you report the loss to UBA (Call CFC on +231 881 968 559)

- — You need to have an active savings or current account. If you don’t have an account with UBA, simply open one. Click here to see which of our accounts is good for you.

- — Completed and signed Debit Card Application Form

| Maximum amount you can withdrawal from an ATM within 24 hours | |

| Maximum amount you can spend on a POS or on the Internet within 24 hours | 000000 |

International transaction limits are subject to market changes.

Your UBA Debit MasterCard can be used for cash withdrawal at any UBA ATM or any ATM where MasterCard is accepted anywhere in the world, as well as for making purchases at over 32 million merchant locations. You can also pay for your bills, recharge your phone online or do much more with QuickTeller.com

- — Available only on the LRD current or savings account

- — It is valid for 3 years from the month of issue

- — It requires a Personal Identification Number (PIN) for all ATM and POS transactions

- — Transfer money instantly from your account to other accounts in UBA or other banks in Nigeria

| Getting a new card | USD5 |

| Replacing a lost, damaged or expired card | USD5/LRD500 |

| Cash withdrawal on ATMs at any UBA branch | US Cents25/LRD20 |

| Cash withdrawal on ATMs abroad* | Acquirer fee |

| Purchases made on POS and on local websites in Liberia | Free |

| Purchases made on POS abroad and on foreign websites* | Free/Acquirer fee |

*Applicable fees for international ATM, POS and WEB transactions are subject to market changes

UBA Gold Debit MasterCard for Domiciliary Account

Get access to your money anywhere in the world with the UBA Gold Debit MasterCard for Domiciliary Account, which also enables internet purchases wherever the MasterCard or Maestro logo is displayed. UBA’s Debit MasterCard for Domiciliary Account products are tied to card holders’ domiciliary accounts, instead of Liberian Dollars current or savings accounts. They offer the same flexibility in usage anywhere in the world, including Liberia, and any of the 1 million MasterCard-enabled ATMs in over 210 countries, as well as purchases at over 31 million merchant locations worldwide. All transactions carried out with the MasterCard for Domiciliary Account are debited from card holder’s Dollar USD Account, depending on the currency in which transactions are consummated.

The UBA Gold Debit MasterCard for Domiciliary Account is a debit card issued on your Dollar, Pounds or Euro account in Liberia. Thereafter, you can access funds in your domiciliary account via your card anywhere in the world. You can travel anywhere you want, stay wherever your heart desires and shop online as much as you could. This is what we mean by Roam your Money.

Your UBA Gold Debit MasterCard for Domiciliary Account can be used for cash withdrawal abroad at any ATM where MasterCard is as well as for making purchases at over 32 million merchant locations.

Convenience and safety in one card

Your UBA Gold Debit MasterCard for Domiciliary Account is extremely versatile and simple to use. You have the convenience of paying for your purchases directly from your UBA domiciliary account, without having to carry cash. That’s the cashless lifestyle! Yet, your card and your transactions are highly secured with the best card technology.

If your UBA Gold Debit MasterCard for Domiciliary Account is stolen or misplaced, you are protected against fraudulent transactions from the moment you report your lost or stolen card to UBA (Call CFC on+231 881 968 559).

- — You need to have an active Dollar, Pounds or Euro domiciliary account. If you don’t have an account with UBA, simply open one at any UBA Business Office near you

- — Completed and signed Debit Card Application Form

| Dollar (USD) | Pounds (GBP) | Euro (EUR) | |

| Maximum amount you can withdrawal from an ATM within 24 hours | 2,000 | 1,200 | 1,500 |

| Maximum amount you can spend on a POS within 24 hours | 10,000 | 6,000 | 7,000 |

| Maximum amount you can spend on the Internet within 24 hours | 5,000 | 3,000 | 4,000 |

*International transaction limits are subject to market changes

- — Available only on Naira current or savings account

- — It is valid for 3 years from the month of issue

- — It requires a Personal Identification Number (PIN) for all ATM and POS transactions

- — Transfer money instantly from your account to other accounts in UBA or other banks in Nigeria

| Getting a new card | N1000 |

| Replacing a lost, damaged or expired card | N1000 |

| Monthly service charge | N50 |

| Cash withdrawal on ATMs at any UBA branch | Free |

| Cash withdrawal on ATMs abroad* | Acquirer fee |

| Purchases made on POS and on local websites in Nigeria | Free |

| Purchases made on POS abroad and on foreign websites* | Free |

*Applicable fees for international ATM, POS and WEB transactions are subject to market changes

All charges such as monthly maintenance charge; international ATM withdrawal charges; etc. attract VAT of 5% in compliance with the regulations of the federal tax bodies.

A transaction fee is applicable to withdrawals from any ATM outside Nigeria. All international transactions must be in accordance with relevant regulations of the Central Bank of Nigeria.

Visa Classic Debit Card

Access your money anywhere with the UBA Visa Classic® Debit Card, which includes making purchases for goods and services wherever the Visa logo is displayed (POS, Web). You can make withdrawals at any of the 2.1 million Visa enabled ATMs in over 200 countries and purchases at merchant locations where Visa is accepted worldwide.

Your UBA Visa Classic® Debit Card is extremely versatile and simple to use. You have the convenience of paying for your purchases directly from your bank account, without having to carry any cash. That’s the cashless lifestyle! Yet, your card and your transactions are highly secured with the best card technology

If your UBA Gold Debit MasterCard for Domiciliary Account is stolen or misplaced, you are protected against fraudulent transactions from the moment you report your lost or stolen card to UBA (Call CFC on +234 1 280 8822).

Your UBA Visa Classic® Debit Card can be used for cash withdrawal at any UBA ATM or any ATM displaying the Visa or V-Pay logo and can also be used to make everyday purchases at merchant locations and web sites where Visa is accepted anywhere in the world.

Your UBA Visa Classic® Debit Card allows you to track your purchases on a regular basis. The details of the purchases made on your card, along with the date, merchant name and amount are mentioned in your bank statement. For more information about receiving your bank statement by email, please visit our UBA Alerts page.

- — You need to have an active Dollar, Pounds or Euro domiciliary account. If you don’t have an account with UBA, simply open one at any UBA Business Office near you

- — Completed and signed Debit Card Application Form

| Maximum amount you can withdraw from an ATM within 24 hours | USD500/LRD20,000 (Can be increased) |

| Maximum amount you can spend on a POS or on the Internet within 24 hours | USD500/LRD20,000 (Can be increased) |

| Maximum amount you can spend on the Internet within 24 hours | USD500(Limit can be increased) |

International transaction limits are subject to market changes

- — Available only on Naira current or savings account

- — It is valid for 3 years from the month of issue

- — It requires a Personal Identification Number (PIN) for all ATM and POS transactions

- — Transfer money instantly from your account to other accounts in UBA or other banks in Nigeria

| Getting a new card | N1000 |

| Replacing a lost, damaged or expired card | N1000 |

| Monthly service charge | N50 |

| Cash withdrawal on ATMs at any UBA branch | Free |

| Cash withdrawal on ATMs abroad* | Acquirer fee |

| Purchases made on POS and on local websites in Nigeria | Free |

| Purchases made on POS abroad and on foreign websites* | Free |

*Applicable fees for international ATM, POS and WEB transactions are subject to market changes

All charges such as monthly maintenance charge, international ATM withdrawal charges; attracts VAT of 5% in compliance with the regulations of the federal tax bodies.

A transaction fee is applicable to withdrawals from any ATM outside Nigeria. All international transactions must be in accordance with relevant regulations of the Central Bank of Nigeria.

Your PIN and CVV2 code (Card Validation Value) would be required to authorize all l web transactions after the UBA Visa Classic® Debit Cardholder activates the Visa Internet PIN (i-PIN) on a UBA ATM terminal.

Your CVV2 (Card Validation Value) code is different from your PIN, it is the last 3 digits written on the signature panel behind the card. It is required for all web transactions done locally and internationally.

UBA Debit Card® User Guide

Your UBA Debit Card gives you electronic access to your Savings or Current account with UBA, wherever you need to use money. Debit Cards are used for instant withdrawal of cash and to pay for goods and services. The funds used during these transactions are immediately debited and

transferred from the cardholder’s UBA account.

- Each UBA Debit Card is issued with an exclusive 16-digit card number. This

number will be quoted in all communications/correspondence with the Bank. It

should be kept secure at all times along with the Personal Identification Number (PIN) and should never be disclosed to any other person. - The Account Name, which the card is linked to, is boldly printed on the issued card and must always be checked at the point of issuance to confirm that the name has been spelled correctly.

- The Expiry Date (mm/yy) is printed on the card and it shows the last valid day of

the month of the year for which the card is valid.

For your safety, all cards are issued inactive. Therefore you must change your Personal Identification Number (PIN) to a new PIN of your choice on a UBA ATM to activate your UBA Debit Card. You can use your UBA Debit Card on UBA terminals and third-party ATMs depending on the card type you are using. The Debit MasterCard can be

utilized anywhere in the world where MasterCard is accepted, which is at over 1 million ATMs and 32 million merchant establishments. This allows you 24-hour access to any of your accounts linked to your Debit Card.

• Effect a cash withdrawal

• Obtain a mini account statement for your last 8 transactions

• Get your available account balance

• Change PIN

• Look for a VISA/VISA Electron/MasterCard/ Maestro/Interswitch sign at the

Point-of-Sale (POS) merchant establishment. The merchant must have an

electronic Point-of-Sale (POS) card swiping terminal

• Present your Debit Card after making your purchase

• The Debit Card will be swiped by the merchant and the customer must input

the card PIN for authorization.

• After a successful authorization, the transacted amount will be debited from

the account linked to your card

• A sales slip will be generated

• Confirm the amount on the pay slip. For international transactions, the

customer must sign the sales slip and the signature must match the one on the

reverse side of the Debit Card

• Ensure your Debit Card is returned to you

• Treat your UBA Debit Card in the same way you treat cash. Keep it with you

at all times and never leave it unattended

• Your Debit Card is for your exclusive use only. It should never be surrendered

to anyone other than a designated Bank Officer at the UBA Branch after it has

been deactivated.

• Never reveal or surrender your personal identification number (PIN) to

anyone. Please destroy all evidence of the PIN number after memorizing it and

never keep a written copy of it in close proximity to your Debit Card

• It also recommended that you change the PIN to a number of your choice

as soon as possible and at regular Intervals

• If your Debit Card is lost/stolen, or if you suspect that your Debit Card has been used fraudulently, promptly call UBA’s 24-hour Customer Interaction Center representatives to report the loss and have the card immediately

deactivated

• In case you need your Debit Card re-issued, kindly walk into any UBA

business office to request for a new one

• Always ensure that the Debit Card is used in your presence when transacting

at merchant establishments

• Always ensure that you are transacting on a secure website when using your

• UBA Debit Card via the internet or in any other ‘card-not-present’ situation

Your UBA Debit Card allows you to track your purchases on a regular basis. The details of the purchases made on your card, along with the date, merchant

name and amount are mentioned in your bank statement. For more information about receiving your bank statement by email, please visit our UBA Alerts page.

If your UBA Debit Card gets lost or stolen, you are protected against fraudulent purchase transactions from the moment you report the loss to UBA (Call CFC on +234 1 280 8822).

All charges such as monthly maintenance charge, international ATM withdrawal charges; attracts VAT of 5% in compliance with the regulations of the federal tax bodies.

A transaction fee is applicable to withdrawals from any ATM outside Nigeria. All international transactions must be in accordance with relevant regulations of the Central Bank of Nigeria.

Your PIN and CVV2 code (Card Validation Value) would be required to authorize all l web transactions after the UBA Visa Classic® Debit Cardholder activates the Visa Internet PIN (i-PIN) on a UBA ATM terminal.

Your CVV2 (Card Validation Value) code is different from your PIN, it is the last 3 digits written on the signature panel behind the card. It is required for all web transactions done locally and internationally.

If you need assistance or have a question, we are always here to help

Lost or Stolen Cards?

If your Debit/Credit Card is lost or stolen, please contact us immediately:

• We will give you a card to use to get cash from cash machines (ATMs) or to withdraw cash and/or make payments for goods and/or services. You must sign your card and change your Personal Identification Number (PIN) to a new PIN of your choice as soon as you receive it.

• You agree that the card shall be kept secured at all times and your Personal Identification Number (PIN) will not be disclosed to any other person.

• You agree that all transactions at any ATM or Point of Sale (POS) made by your card and with your PIN will be treated as authorized by you and in line with your account mandate. The bank will not accept any liability for any alleged unauthorized use of the card.

• You must take all reasonable precautions to prevent the card and PIN from being used fraudulently or you might be liable for any losses incurred by you.

• Not interfering with any magnetic stripe or integrated circuit (chip) in the card;

• Not disclosing the card number except when properly using the card;

• Destroying any notification of your PIN;

• Not writing down or recording in any format any PIN or disclosing it to anyone else (other than any additional cardholder) including the police and/or bank officials;

• Not using weak PINs that can be easily guessed (e.g. 1111, 0000, 1234, birthday, wedding day etc.)

• Complying with any other instruction we may advise from time to time regarding keeping the card, card number and your PIN safe

• You agree that card shall expire on the expiry date stated on the card and the re-issuance of another may be at the discretion of the bank.

• You agree that the card is the property of United Bank for Africa PLC. and may be withdrawn from you on demand. You also agree that the bank will not be liable if a circumstance warrants the card to be trapped by an ATM.

• The bank will not be liable for any machine malfunction, strike, dispute or any other circumstances affecting the use of the card.

• The bank shall not be liable for any events that may occur after ATM has successfully dispensed cash to you for your withdrawal transactions.

• Withdrawals from ATMs with your card and PIN shall not exceed a maximum limit as may be specified by the Bank from time to time without prior notice to you.

Limiting Your Right to Use the Card

• A card issuance fee is applicable to your account.

• Replacement cost for lost, stolen or renewed cards would be charged to your account as applicable. Once you report a lost or stolen card, we will ensure that your account is temporarily blocked in order to prevent unauthorized usage.

• You will be required to obtain a new card from us for the replacement of lost, missing, damaged or stolen card OR when PIN is forgotten.

• The bank reserves the right to charge fees and commission on your transactions as it may deem appropriate for use of this service by you.

What You Should Notify Us Of

• Immediately your card is lost or stolen or you think that the card may be compromised misused or if the PIN is disclosed to any unauthorized persons or suspected to have been compromised.

• If your statement includes an item which you think is wrong.

• Immediately you change your name, phone number or address.

Limits of Liability

• Until you notify us that your card is lost, stolen or at risk of being misused you will be liable for transactions before we acknowledge the receipt of the notification.

• If someone uses your card whether or not with your permission,; you will be liable for all the transactions which take place prior to you notifying us that there is a danger of the card being misused.

• We will not be liable to you if we cannot carry out any or all our responsibilities under this agreement as a result of anything that we cannot reasonably control. This includes any equipment failures, industrial disputes, natural disasters, or acts of God

Refunds and Claims

• We will credit your account with a refund for any transaction or incorrect debit to your account, which you have reported, only after an independent investigation is conducted by us and we are satisfied that your claims are genuine.

• You will be requested to provide us with full details of any transaction you want to dispute.

Terminating this Agreement

• This agreement will come to an end if either party gives a written notice to the other to that effect and you have returned all cards and made all payments due under this agreement